|

| Applying the brake in the name of patient care? |

Go to the websites of organizations like Robert Wood Johnson or The Brookings Institution and you'll find impressive expert papers that extol a variety of "payment reforms" designed to "align incentives," "reduce waste" and "achieve cost savings." Dig into these reforms and readers will encounter admiration for payment approaches like "prospective payment," case-based," "bundling," and "shared savings." You'll also find a deep disdain for "fee-for-service" (FFS).

Prospective good, FFS bad, right?

"Not always," replies the DMCB. It depends on your point of view. Like, if you're a patient.

The DMCB explains.

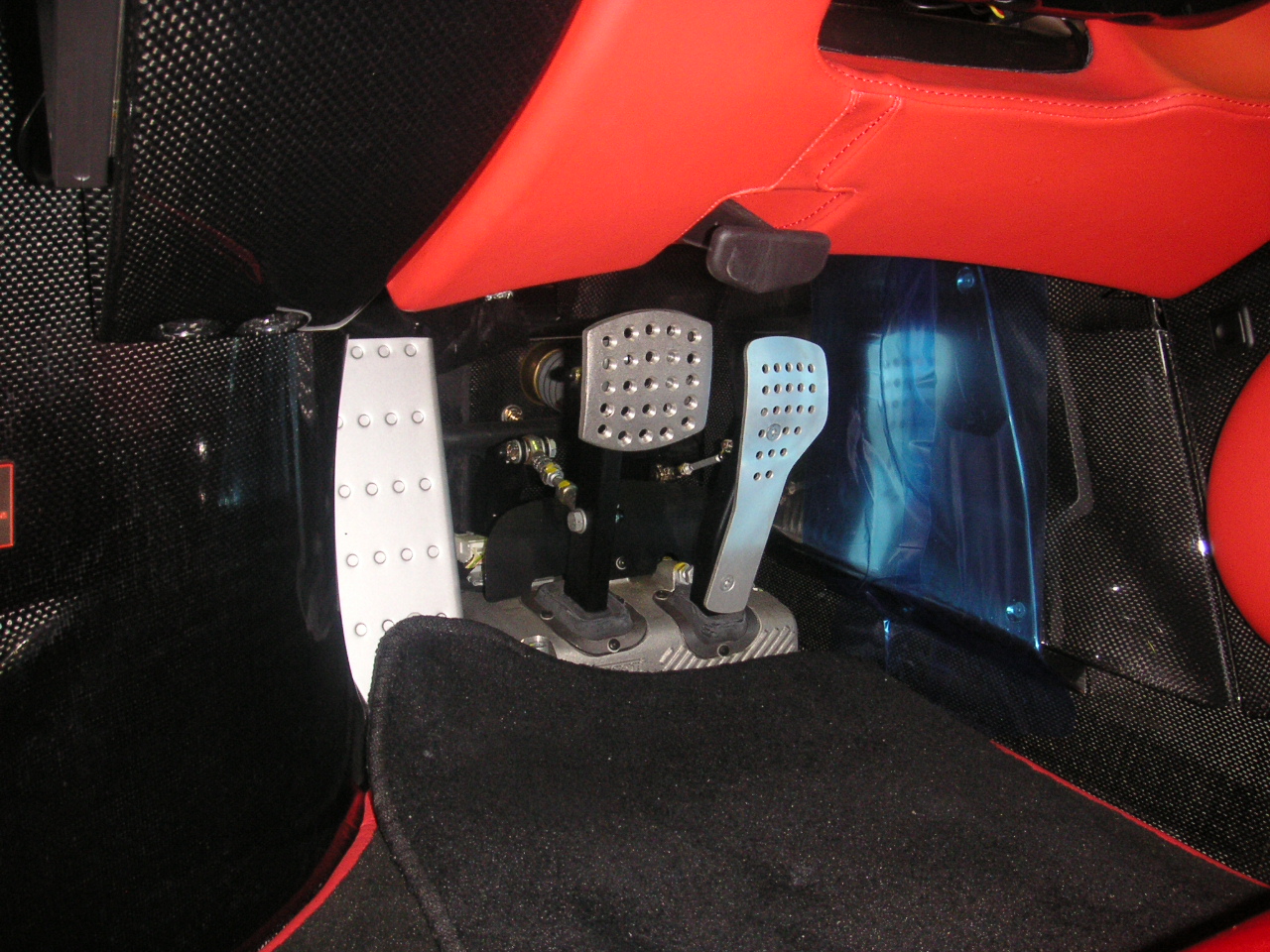

The DMCB learned long ago to simplistically think of provider payments in terms of "gas" and "brake" pedals. FFS applies gas and accelerates provider services; that's because each time a "service" is provided it subsequently generates a "fee."

In contrast to FFS, case payment, bundling and capitation apply the brakes, because providers receive the payments up-front. Since the money is in hand, providers have an economic incentive to preserve it and withhold services. The DMCB thinks of "shared savings" in terms of brakes because the up-front payment is essentially held in escrow until the savings (versus a targeted level of utilization) are achieved.

The simplest example of how this can be applied is to hospitalization. If hospitals are paid for each day that the patient is in a hospital, that's FFS (otherwise known in the industry as "per diem").

Instead of per diems, most hospitals are paid with a different payment mechanism based on "diagnosis related groups" (DRGs). Every time a patient is admitted, that generates a payment (similar to FFS). That payment, however, is not pegged to the number of days the patient stays in the hospital. Instead, the payment is bundled to pay for the entire hospitalization. That's why hospitals are always willing to admit patients (the gas) and then in a hurry to discharge them (the brakes).

Under the payment reforms championed by Robert Wood Johnson or The Brookings Institution, the inpatient payment bundling would be expanded to pay for the entire case after discharge from the hospital. Under this system, if the case had to be readmitted, the hospital and providers are SOL. After all, why should they be rewarded for shoddy care?

Unless, of course, you're the patient. The DMCB worries that a one-size-fits all approach to payment policy could have unintended consequences. Patients battling unanticipated outcomes would likely prefer that their providers be incented to give additional care. They want to be back in the hospital.

The payment policy may be good from the point of view of health reform, but it can be bad for patient care.

The DMCB asks if we are on the verge of another round of unintended health care consequences.

We'll know soon enough when anecdotes of patients being inappropriately denied readmission begin to appear.

I’ve wondered when the AARP and Time Magazine will figure out that capitation payment (which is essentially how ACOs are paid) will pay providers even if they provide no care to the covered population. As far as I know there are no quality metrics that measure a non-admission (a person who should have been admitted but wasn’t), so there aren’t financial penalties for withholding care – despite the efforts of the “pay for quality” advocates.

ReplyDeleteThere are payment systems that incent providing more care, and systems that incent providing less care. There doesn’t seem to be anything implementable between them.

There appears a quasi-holographic image of the smiling senator Franken somewhere in DMCB's banner. Perhaps the work of a nefarious coder? Anonyomous?

ReplyDeleteWhat irony. It turns out that the Google blog webmasters of the universe were likewise intrigued by this - it had never happened before. I discovered the bullying actuaries posting had TWO images of Franken embedded in it and one of them had "migrated" into the banner. I deleted the image and voila! problem solved.

ReplyDelete