While the prescient Disease Management Care Blog was among the earliest to identify the threat of an Obamacare-induced insurance "death spiral," it missed spotting the potential fallout from a delay of the individual mandate.

While the prescient Disease Management Care Blog was among the earliest to identify the threat of an Obamacare-induced insurance "death spiral," it missed spotting the potential fallout from a delay of the individual mandate.As shrewdly pointed out in this Politico article, health insurance timelines require at least three months of claims experience to inform future rate setting. Once that actuarial work is done, it then has to go through the states' Insurance Departments for approval.

In other words, if large numbers of Obamacare customers are allowed to sign up after March 31, 2014, insurance companies won't know what to charge their customers on January 1, 2015.

While overcharging can be remedied by customer rebates, it remains to be seen how accommodating Washington DC will be if the insurers undercharge. That means negative cash flows, raiding surpluses and facing the ire of their investors and Boards of Directors.

It's baseball season, so think of the death spiral as a potential strike one, and inaccurate rate setting as a potential strike two.

Which brings the DMCB to a dreaded strike three. If it happens, the health reform brand could be irretrievably tarnished. It could also and sink the current version of Obamacare.

Strike three would be a critical mass of inaccurate insurance policies.

If reports like this and this are even remotely representative of the back-end of Obamacare enrollment, the relative trickle of individuals who are successfully navigating the exchanges are getting commercial polices that depend on a very vulnerable reconciliation process involving many moving parts. That includes information from the "hub" as well as user-based data entry. As noted in this report, commercial insurers are being forced to manually "clean up" the information prior to issuing their exchange-generated policies.

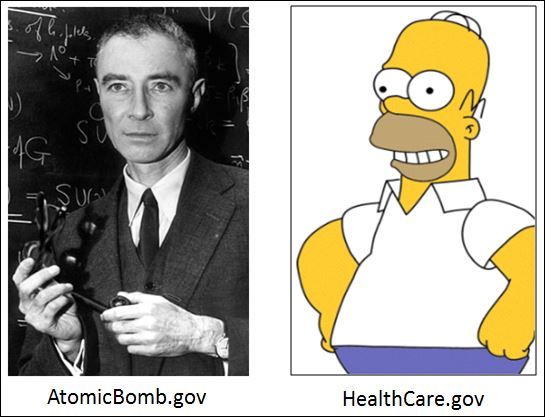

The DMCB suspects that a "garbage in, garbage out" adage may apply. Thanks to sheer number of inputs, clean-up mistakes are going to be inevitable. And it will get a whole lot worse if the healthcare.gov web site gets only partially fixed.

While a few mistakes are acceptable in large risk pools, more than a few could be huge problem at three levels:

1. At a business level, where a core competency of insurance companies is to cover their enrollees and only their enrollees. Insurance companies are really good at knowing who is and who isn't insured for a covered or non-covered service with or without a variety of co-insurance arrangements. It's more than just getting it right, it goes to the core of their business model. If enough policies are inaccurate, it could bring the finances of some smaller health insurers to their knees.

2. At national health policy-making level, where a critical mass of insured customers with premiums and subsidies mismatched to the risk could destabilize the market and distract our political leaders. Think about the customers who assume a service is covered, providers who expect to get paid accurately, balance sheets that don't reflect the truth about claims expense as well as IBNR and regulators who will need to sort it all out.

3. At an Obamacare "brand" level. Think about all those unfriendly and anecdotal news reports about vulnerable patients who ended up legitimately - if mistakenly - paying more out of pocket for care, or persons mysteriously lacking insurance, or hospitals and doctors being unable to get paid. It could ultimately track back to the HealthCare.gov web site that everyone will loves to hate.

The worst part is that the White House has done such a masterful job of bullying the insurers that it's unlikely that they'll want to rock the boat by going public with any notification that their enrollment data is corrupted. Mr. Obama will naturally claim that he wasn't in the loop and his loyal aides will deflect blame elsewhere.

Strike three, and we may not even see it coming.

2 comments:

Let's go back to not for profit health insurance companies to do away with the dreaded keeping of CEOs bonus and shareholder dividends intact. Better yet, let's join the rest of the civilized world and have single payer universal coverage in America. Health care is too important to turn into a political and business kickball.

Michael Wild

And so it begins. While conservatives continue to beat their drums, progressives are tacking left, criticizing the current ACA status quo for not being single payer. No one is happy.

Post a Comment